Date: Mar 26, 2024 | Time: 2:00 pm | Location: Ellily Hotel

Addis Chamber Export Portal

Date: Mar 26, 2024 | Time: 2:00 pm | Location: Ellily Hotel

This week’s Business Opportunities (BO) alert focuses on • Import Opportunities • Trade fair Opportunities • Best export price 1.…

This week Business Opportunities (BO) alert focuses on • Import Opportunities • Partnership Opportunities with sir Lanka • Trade fair…

This week Business Opportunities (BO) alert focuses on • Announcement • Import Opportunities • Partnership Opportunities with sir Lanka •…

This week Business Opportunities (BO) alert focuses on • Partnership Opportunities with sir Lanka • Best export price 1. PARTNERSHIP…

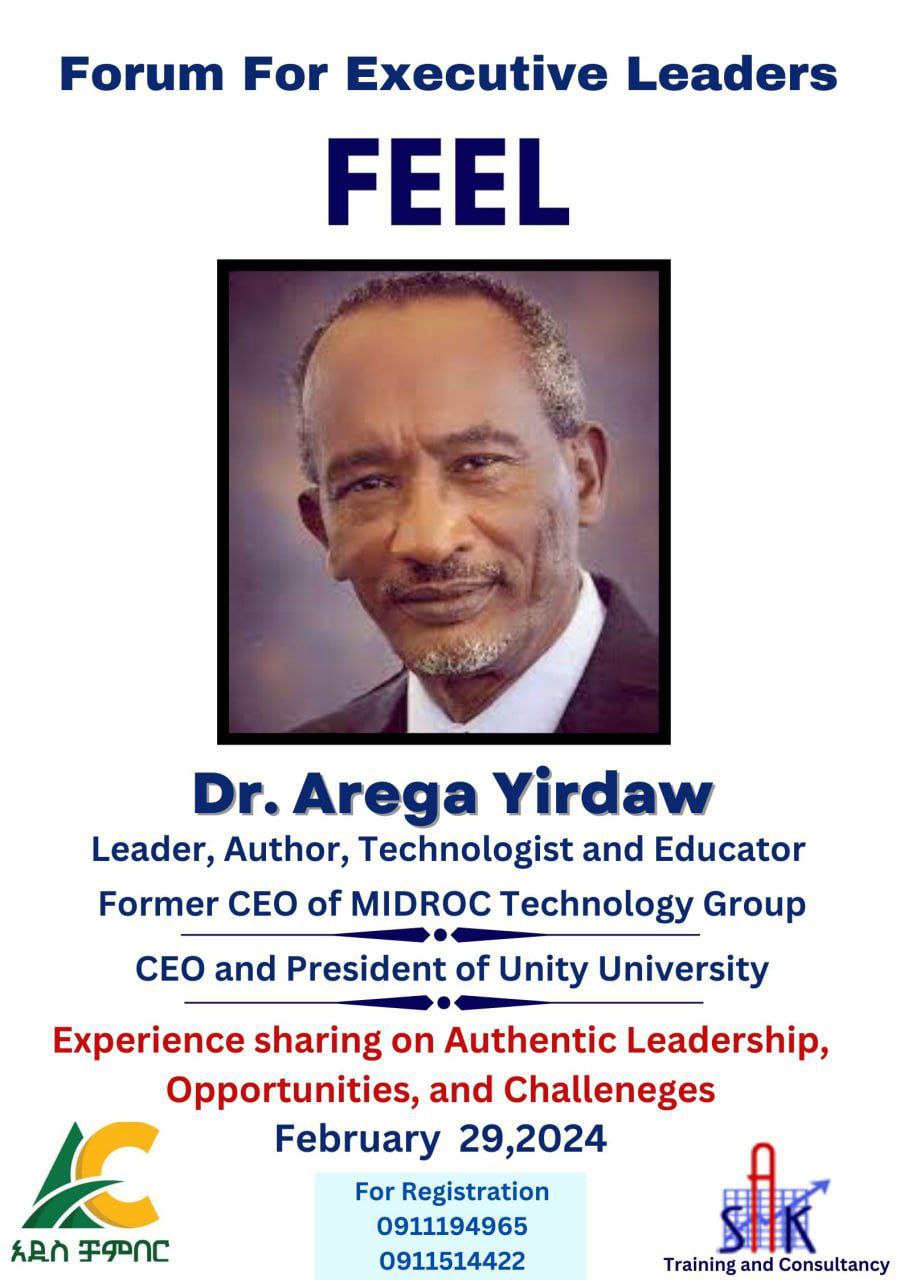

Forum for Executive Leaders (FEEL) program, February 29, 2024 Addis Ababa Chamber of Commerce and Sectoral Associations (AACCSA) pleased to announce…

This week Business Opportunities (BO) alert focuses on Partnership Opportunities with sir Lanka Best export price 1. PARTNERSHIP OPPORTUNITIES Name…

This week Business Opportunities (BO) alert focuses • Import • Consumer Goods international trade fairs and • Best export price…

This week Business Opportunities (BO) alert focuses • Import • Consumer Goods international trade fairs and • Best export price…

This week’s Business Opportunities (BO) alert focuses • Import • Consumer Goods international trade fairs and • Best export price…